The modern financial landscape is rapidly evolving, yet traditional banking often lags in adapting to the needs of the global, digitally-savvy individual, particularly concerning cryptocurrency. Challenges like blocked crypto transactions, difficulties with offshore accounts, and the inherent custody risks of many card providers create significant friction. Connect.ac, recognized for curating vetted digital opportunities, introduces

BXPay – an innovative banking solution designed to dismantle these barriers. BXPay seamlessly integrates debit cards, flexible offshore accounts, and blockchain technology, empowering users with ultimate control over their crypto and fiat assets. This review will explore BXPay’s unique proposition, its place within the Connect.ac ecosystem, and how it delivers a next-generation, borderless banking experience.

Connect.ac’s Role in Empowering Global Finance with BXPay

Connect.ac’s core mission revolves around providing its community with access to cutting-edge digital tools and opportunities. BXPay stands as a testament to this commitment, addressing a critical need for integrated banking solutions that embrace, rather than resist, the decentralized future. By bringing BXPay into its portfolio, Connect.ac offers its members a sophisticated yet user-friendly answer to traditional banking limitations, especially for those operating in the crypto space.

The Connect.ac framework ensures that products like BXPay are not isolated services but integral parts of a coherent strategy. This integration guarantees streamlined access, consistent support, and a unified user experience. Members engaging with BXPay through Connect.ac benefit from the overarching advantages of the ecosystem, including a supportive community, transparent operational standards, and the assurance of a vetted offering, all while leveraging BXPay’s specialized financial capabilities.

Understanding the Evolution: The Need for Borderless Banking

Traditional banking systems, by their nature, are often geographically constrained and slow to adapt to new technologies. This creates significant hurdles for individuals and businesses operating internationally or dealing with digital assets:

- Crypto Restrictions: Many conventional banks actively block or restrict crypto-related transactions, making it difficult to bridge the gap between digital wealth and real-world spending.

- Offshore Account Complexity: Setting up and managing offshore accounts for privacy or asset protection can be a cumbersome and inaccessible process for the average user.

- Custody Risks: Many existing card solutions take custody of a user’s funds, negating one of the primary benefits of cryptocurrency – self-sovereignty.

These limitations highlight a growing demand for financial services that are truly global, crypto-friendly, and user-centric, putting control back into the hands of the individual.

What is BXPay? Your Banking Solution Without Borders

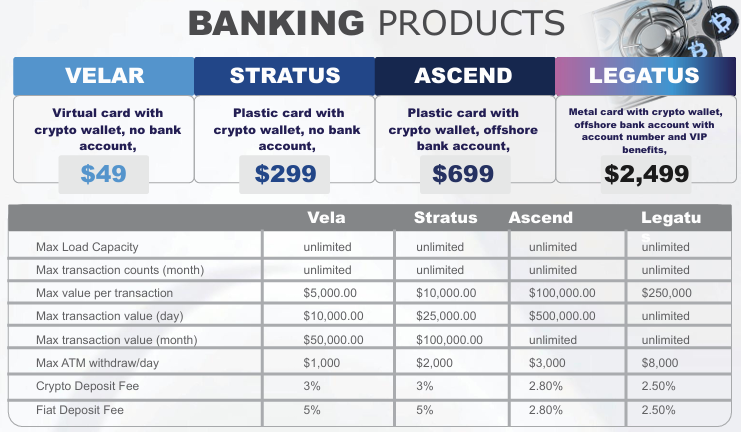

BXPay is presented as a comprehensive banking solution designed to overcome the limitations of traditional finance by prioritizing custody, flexibility, and crypto integration. It offers a suite of products (Velar, Stratus, Ascend, Legatus) each tailored to different user needs, all built around the core principles of decentralization and user control.

Think of BXPay as your personal financial bridge, allowing you to seamlessly move between crypto and fiat, manage funds globally, and spend with ease, all while retaining ownership of your assets. It eliminates the “middleman” complexities often associated with both traditional banking and existing crypto-card solutions, providing a direct and efficient pathway for managing your wealth.

Key Features and Benefits of BXPay

BXPay is engineered to provide a seamless, secure, and user-controlled banking experience, addressing critical pain points for a global and crypto-native audience:

- Custody First: Your Money, Your Control: Unlike many traditional services or even some crypto cards, BXPay emphasizes that your crypto and fiat remain under your direct control. This is a fundamental shift, empowering users with true ownership and significantly reducing counterparty risk.

- Flexible Banking: Virtual and Personal Offshore Accounts: BXPay offers the convenience of both virtual accounts and, depending on the product tier, personal offshore accounts. This provides unparalleled flexibility for managing funds across borders, enhancing privacy, and diversifying asset locations without the typical bureaucratic hurdles.

- Products with Cards: Seamless Spending: All BXPay products (Velar, Stratus, Ascend, Legatus) include a crypto wallet and a debit card, allowing users to spend globally. This feature directly addresses the challenge of converting crypto to fiat for everyday purchases, making digital assets truly usable in the real world.

- Velar ($49): A virtual card with a crypto wallet, ideal for those seeking an affordable entry into crypto-to-fiat spending with robust transaction limits.

- Stratus ($299): A plastic card with a crypto wallet, offering higher transaction limits than Velar for more frequent use.

- Ascend ($699): A plastic card with a crypto wallet and a personal offshore bank account, providing enhanced banking capabilities and significantly higher transaction limits.

- Legatus ($2,499): The premium offering with a metal card, crypto wallet, personal offshore bank account with account number, and VIP benefits, designed for high-volume users requiring maximum flexibility and premium services.

- Simplified Funding and Spending: The process is straightforward: open your chosen BXPay product, fund your wallet with crypto or fiat, and then either transfer crypto to your personal fiat account (if included) or spend globally with your card.

- Transparent Fee Structure: The provided details clearly outline deposit fees (Crypto Deposit Fee: 3-2.5%; Fiat Deposit Fee: 5-2.5%), allowing users to understand costs upfront.

- High Limits Across Tiers: BXPay products offer generous, often unlimited, load capacities and transaction counts, with significant daily and monthly transaction values and ATM withdrawal limits, catering to a wide range of financial needs.

BXPay Vision & Mission: Redefining Financial Control

BXPay is driven by a clear vision:

- Empower Users: To provide individuals with complete control over their crypto and fiat assets.

- Remove Borders: To eliminate geographical and traditional banking restrictions on financial transactions.

- Seamless Integration: To create a frictionless experience between blockchain technology and everyday financial needs.

- Privacy and Asset Protection: To offer a solution where user privacy and the security of their assets are paramount.

Final Verdict: Unlocking Borderless Banking with BXPay via Connect.ac

BXPay, as a cornerstone offering within the Connect.ac ecosystem, represents a pivotal advancement in personal finance. By directly confronting the limitations of traditional banking and embracing the power of blockchain, it delivers a solution that is both incredibly flexible and inherently secure. For individuals, entrepreneurs, and digital nomads seeking a banking product that truly understands and facilitates a global, crypto-integrated lifestyle, BXPay, facilitated by Connect.ac, offers an unparalleled and empowering financial experience. It’s more than just a card; it’s your money, your banking product, your control.

Learn more about BXPay by registering with Connect now!