Steady-Hand Central Banking in a Noisy Cycle

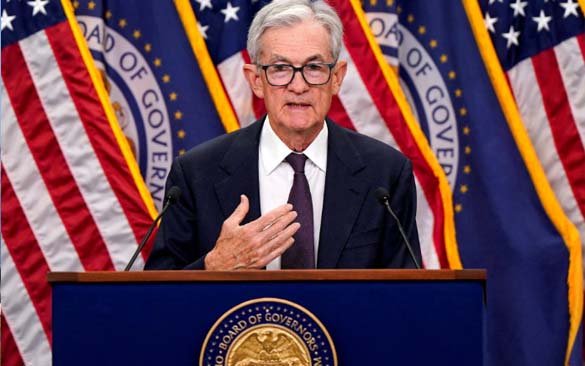

As Jerome Powell continues to lead the U.S. Federal Reserve, economists and investors alike expect few major shifts in monetary policy strategy. The Fed’s recent playbook—anchored in data-dependence, transparent communication, and gradual adjustments—has become a defining feature of Powell’s tenure.

In an era where markets oscillate between demands for rapid tightening and hopes for early pivots, Powell’s Fed has opted for measured pragmatism. Credibility, in this cycle, remains the real currency.

The Post-Pandemic Reaction Function

The pandemic fundamentally changed the Fed’s reaction function—the framework that guides how it responds to new economic data. Initially focused on emergency support, the Fed later transitioned toward managing the dual challenge of inflation persistence and uneven supply-side recovery.

Key features of Powell’s approach include:

-

Broad labor-market analysis: Looking beyond nonfarm payrolls (NFP) to metrics like participation rates, wage pressures, and job openings.

-

Data-driven calibration: Adjusting policy only when inflation or employment trends show sustained shifts rather than reacting to month-to-month volatility.

-

Communication as policy: Using speeches, press conferences, and forward guidance to temper market expectations before taking formal action.

This steady-hand approach helped the Fed maintain credibility during the fastest tightening cycle in decades—while avoiding unnecessary panic in financial markets.

Why Few Changes Are Expected

Economists see continuity rather than disruption ahead. The Fed’s current framework—balancing price stability and full employment—is unlikely to change materially unless inflation expectations become unanchored or the labor market deteriorates sharply.

Even as political and market pressures rise, Powell’s communication strategy remains clear: policy will evolve only when the data does. That message, repeated consistently, has reduced the odds of surprise shocks and reinforced the Fed’s reputation for discipline.

What Could Force a Regime Shift

While the baseline outlook favors stability, several scenarios could push the Fed into a new policy regime:

-

De-anchoring of inflation expectations, prompting a more aggressive tightening cycle.

-

Credit-market stress or banking accidents, which could force an abrupt pivot toward liquidity support.

-

Fiscal-monetary cross-currents, where government spending or debt dynamics complicate the Fed’s policy path.

Each would test the boundaries of Powell’s steady-hand strategy and potentially redefine how “data dependence” is applied in practice.

Bottom Line

Powell’s era will likely be remembered for discipline amid disruption—a balance of transparency, flexibility, and restraint that shaped market behavior as much as it did interest rates. Until the data tells a different story, steady policy remains the Fed’s most powerful signal.